New construction has historically been the relief valve for a housing market that is too tight, that is, with fewer homes for sale than buyers in the market. It has been a pretty reliable cycle over the years. Demand rises. Builders respond by building more homes, often taking on more risk by building more speculative homes. After a year or two, too many builders respond and there is an excess inventory of new homes. Building slows until there are not enough homes for sale. Wash, rinse, repeat. That cycle changed dramatically after the mortgage crisis of 2007-2008 and the pandemic added more new twists.

The problems of the housing market fall into two major categories: those caused by the imbalance in the supply and demand of homes; and those caused by the cost to build and price to buy homes. The causes for the problems facing new home construction today include unusual demographic influences, regulations that squeeze developers and lenders, higher mortgage rates, even higher inflation, a shortage of land, and a shortage of workers. Add in a dash of Millennial generation caution and a tablespoon of economic uncertainty and you have the recipe for a tough new construction market.

There are more than enough reasons why homebuilders should be gloomy about their prospects for 2023, yet it is hard to find a builder that has not seen an upswing in traffic and interest in new construction since the beginning of the year. It is likely that 2023 will be an unusual year for new construction but it may not be a bad one.

The Economic Ingredients

If you read the news, you are probably expecting that the combination of high inflation and the Federal Reserve Bank’s interest rate hikes is pushing the economy towards recession. The early indicators of a slowdown often show up in the housing market. Buying a home is a life-changing decision and the uncertainty of a possible recession tends to move potential home buyers to the sidelines. At the end of 2022, there were lots of signals that this was happening. In the Pittsburgh housing market, however, home buyers may not have seen the memo.

“Activity for prospects has been much better than I anticipated for January and February. It’s even with the activity level at the same time in 2019,” says Steve Fink, president of Paragon Homes, a custom builder and developer based in Collier Township.

Jeff Costa, president of Costa Custom Homebuilders, concurs with Fink on the resurgence in traffic since the beginning of the year.

“We slowed down quite a bit in the last two or three months of last year. We were happy to have the chance to catch up, actually, Costa says. “That was pretty obviously from the shock of the higher mortgage rates. I don’t know whether it is because people have gotten used to the higher rates or not but we have seen an increase in activity since the middle of January. We have six or seven new contracts since then. Our volume for this year is going to be what it was in 2022, but it will be steadier.”

Builders and real estate professionals agree that the combination of higher rates and economic uncertainty should be producing tougher market conditions. While there has been evidence of the market tightening, many are seeing buyers behaving as though the economy is not a concern.

“It’s weird. The economy added almost a million jobs since January, but inflation is still rampant It’s $4.50 for a dozen of eggs but parking lots at restaurants are full. People are still getting on expensive flights. Hotels are full, but offices are empty. Homes are still reselling,” says Paul Scarmazzi, CEO of Scarmazzi Homes. “I think people are still adjusting to interest rate shock. The first-time buyer has really been hit hard. Our segment is still pretty solid. Our sales are strong. We have a strong backlog. I was looking at our traffic for the month of February and we had 43 initial traffic counts, 20 returns, and 21 appointments with limited availability.”

Scarmazzi Homes caters to the empty-nest segment of the market, building mostly detached single-family homes in no-maintenance communities. The empty-nester community appeals to those moving away from their family home, and also to working couples who want to avoid many of the headaches of maintaining a home. The demographics of Western PA favor that segment of the housing market, but demand is strong in all segments.

“We are still seeing multiple offers. Homes that are priced correctly sell right away. There is still an inventory problem not a demand problem,” says Tom Hosack, president/CEO at Berkshire Hathaway HomeServices The Preferred Realty. “On the new home side there are issues of building fast enough, with the shortage of materials and labor. Pricing can be problematic. But the builders that know what they’re doing are building as many as they can. The ones that don’t have slowed down.”

Asked whether the factors limiting his business were coming from supply or demand, Costa replied immediately. “Supply,” he said.

“Don’t misunderstand, demand is lower than it was two or three years ago, but there are still plenty of buyers in the market,” he says. “The Fed raised interest rates too far, too fast, and that took some people out of the market, but we are still busy. We have the capacity to build more homes if we could find more lots.”

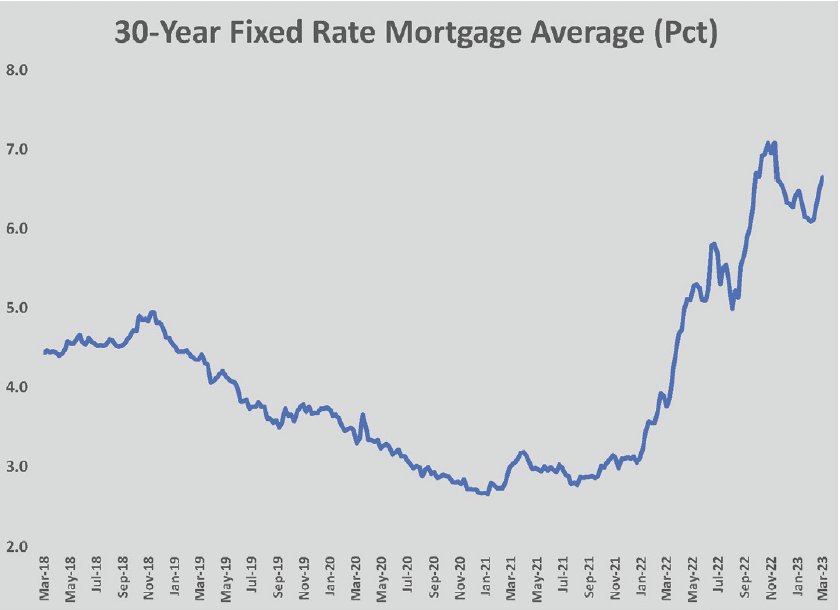

What you learned in Economics 101 applies to new home construction as much as any other facet of the economy. The market is driven by the relationship of supply and demand. It was the severe disruption of the global supply chain that drove inflation higher when vaccines began to free Americans from the worst of the pandemic in mid-2021. To beat high inflation back down to the preferred two percent rate, the Federal Reserve Bank hiked interest rates seven times in 2022 and early 2023 to squelch demand. That added five percentage points to prime rates and doubled the 30-year mortgage rate.

At the national level, the monetary tightening worked. Existing home sales fell 17.8 percent from 2021 to 2022, according to the National Association of Realtors (NAR). New homes sold at a rate that was 16.4 percent lower than in 2021. New construction was down only 3.1 percent in 2022, according to the Census Bureau, but that was because apartment construction jumped 15.1 percent. That increase was also a function of the higher mortgage rates, which forced several hundred thousand potential buyers to remain renters. New single-family starts were off more than 10 percent.

Recent NAR data on new home sales highlighted how the higher rate environment has created difficult conditions for new construction. There were 640,000 new homes sold in February 2023, an increase of 1.1 percent over January. The better sales were credited to effective incentives and mortgage rate buy-down programs that home builders were offering buyers. At the same time, the inventory of unsold new homes rose to 8.2 months’ supply (compared to 2.6 months’ supply of existing homes) and the number of homes that have been permitted but are not started rose to 15,000. The number of homes priced at less than $300,000 declined from 15 percent to 10 percent during the previous 12 months.

New construction slowed significantly in metro Pittsburgh last year as well. Permits for new single-family homes fell by 18.6 percent, or nearly 650 homes. Including permits for new multi-family properties, construction of new residential projects fell by 21.6 percent compared to 2021.

Digging below the surface of the housing data you see that the largest share of the decline was in the middle of the market, the large slice of the Pittsburgh market that is dominated by NVR and Maronda Homes. Demand for larger custom homes has remained solid.

“We’ve shifted to high-end homes. We’re building homes along the water with views of the river, so my price points have gone up,” Dan Mancosh, principal at Brooks and Blair Homes LLC, builders of the Rivers Edge of Oakmont. “We’re also seeing that when you get above a certain price, buyers with more wealth and liquidity and the desire to change their lifestyle have the capacity to do so. Our activity is not as robust, but we are selling to a more discriminating buyer. The market for those homes is bigger than I thought it was a few years ago.”

The Financing Ingredients

On the demand side of the equation, the higher cost of borrowing is the overwhelming influence on the new construction market. During the course of 2022, long-term interest rates rose to roughly the same degree as the Fed Funds rate. This impacted buyers in obvious and subtle ways, but also chilled new development dramatically.

For buyers, the tightening monetary policy resulted in dramatically higher mortgage rates. A 30-year loan closed before the Christmas holiday in 2021 carried a rate of 3.1 percent. Mortgage rates bumped up to 3.5 percent over the next six weeks. Within three months, rates touched six percent and were above 6.5 percent in early March 2023. For a typical mortgage of $250,000, that rate increase added $500 to the monthly payment. That is enough to knock a significant share of potential buyers out of the market. For new construction, which tends to have an even higher price tag, the impact is magnified.

Darlene Hunter, vice president and regional manager, new construction for Howard Hanna Real Estate Services, is seeing a gap emerging between buyers and builders that is slowing sales.

“We have communities that have product and many inquiries from buyers but are not hitting their price point. Buyers have expectations that they can negotiate the price because of what they hear in the media. It’s hard to negotiate on new construction. New homes cost what they cost,” Hunter explains. “New constructions inventories are down. The builder isn’t going to give away what they have. The builders around here are solvent and are not going to make bad deals just to clear out inventory.”

The dramatic escalation in construction costs that began in the first summer of the pandemic lifted the price of new construction well above what was simply appreciation from higher demand. Mancosh points out that those costs handcuff builders in a way that do not apply to existing homeowners. When a market softens, homeowners almost always have more room to accept a lower offer, since the impact of a lower price means less appreciation. For builders, there is a clear floor below which accepting a lower price means losing money. With more buyers in the market than sellers, homebuilders can be holding the line of pricing more easily than an existing homeowner.

“Existing homes values can drop based upon demand in the market. People selling homes have an expectation of value but they have to move the price depending on the market,” says Mancosh. “On a brand-new build these days the cost won’t permit us to reduce prices

“If you read the headlines, you’d think we are going to have a double digit decrease in housing values. Certainly, anything is possible but that will take a dramatic hit to the economy,” says Mike Henry, senior vice president of residential lending for Dollar Bank.

New construction has other nuances that can dampen demand as rates increase. The sales cycle for new construction tends to be longer than for an existing home. During 2022, a delay in a buying decision of two or three months cost hundreds in mortgage payments. Moreover, the financing mechanism for new construction is typically a variable rate loan that converts automatically to a permanent mortgage when the home is completed. Most banks smooth the process by allowing homeowners to lock in a mortgage rate before construction starts, but lenders must factor in the risk of rate increases. New construction loans went up in cost more and quicker than mortgages for existing homes. The volatile rate conditions added another layer of uncertainty to new construction, but is not killing the market.

“What we hear about new construction is regulation is a deterrent; the cost of development is a deterrent, and builders are having a lot of trouble finding people to work,” says Henry. “Maybe it’s rates but builders have incentives to overcome that.”

“Our biggest concern with buyers is on borrowing. Are they able to qualify and will they accept what it will take to qualify,” says Fink.

The more subtle impact the higher rate environment has on new construction is that existing homeowners become more reluctant to sell their home financed at lower rates. Because of the zero-interest rate monetary policy that existed during the 2010s, almost 99 percent of the existing mortgages in the U.S. were below six percent, according to Goldman Sachs. Most of those were below four percent.

“As you got closer to six percent, fewer homeowners are willing to switch out of their current mortgages,” says Henry.

Borrowing for development of new residential lots is different than construction of new homes, which operates essentially like a mortgage for the homeowner. Residential development is considered a commercial loan, which means it is subject to different regulations than a residential mortgage. While many of the rules established under the Dodd Frank Act after the mortgage crisis in 2008 have been eased or erased, there continue to be requirements for commercial loans that add significantly to the cost of residential development.

Fink notes that financing conditions for new development are more difficult than just five years ago. He explained that the renewal of a lending agreement that was 90 percent repaid had become difficult because of bank regulations. The reserves that the bank was required to hold against the loan were high enough to make the profit from the financing undesirable, even with interest rates that are more than three percentage points higher. The Federal Reserve Bank registered this decline in appetite for residential construction and development loans in its most recent survey of lenders, 69.2 percent of which said they had tightened lending standards.

With the costs of development construction escalating 20 percent or more due to inflation and borrowing costs three percentage points higher than a year ago, developers need lenders to be more receptive. But regulations tie the hands of even the most agreeable banker. Taken all together, the current financing conditions are the ingredients for fewer new lots, not more.

“I think rates are going to continue to rise, which will continue to dampen new home construction sales,” predicts Scarmazzi. “Land positions are getting more difficult. The builder is looking at the land and going back to the developer for some help, but there isn’t much help to be given. Horizontal costs have increased just as much as vertical construction. A developer isn’t going to pay a builder to develop lots for them.”

“We’re being told that banks are pulling back on new development loans. Banks are still lending to developers that are existing customers but aren’t taking on new developers as customers,” Costa reports.

That trend, if true, would cut both ways in Pittsburgh. One of the limitations on the new development inventory has been the demographics of the developer community, the fact that fewer firms are getting into residential development than the market needs. The move away from new development loans means that companies eying residential development as a growth opportunity will find it difficult to get credit. But the sword cuts both ways. The fact that there are so few new developers in Western PA means that long-term developers should be able to access loans for new projects. However, lack of credit is only one of the barriers to new development.

Developers have longed joked about available land being “Pittsburgh flat,” meaning that what is available requires only modest excavation and fill to make usable for new home construction. Unfortunately, there is precious little land on the market that is “Pittsburgh flat.” Moreover, with the cost of land skyrocketing since the 2010s, and the cost of horizontal construction jumping significantly higher at the same time, even “Pittsburgh flat” land yields lots that are much more expensive than before the mid-2000s housing boom.

Pittsburgh’s demographics and economics have created a pool of buyers that are proving to be resilient to the more difficult conditions of higher rates and tighter new home inventory. The small new construction supply coming onto the market has yet to outstrip the prospective buyer pool, although the type of buyer has become limited. Hunter points to the River’s Edge community in Oakmont as an example of a new construction neighborhood that is thriving, in spite of million-dollar price tags. A new construction market that is geared toward the higher end of the market also has buyers that can be more financially flexible. That mitigates the impact of the soaring mortgage rates.

“The mindset of many buyers now is not that they have a 30-year mortgage that they will pay for 30 years. The mindset is that it is a short-term mortgage that I pay until rates are where I want them to be,” says Hosack. “It has also become socially acceptable to take your 401K and buy a house. When people were only accepting cash offers, buyers started using whatever resources they had to compete, because it was not the permanent financing to get the house. In many cases buyers refinanced and replaced the money in six months. People are more aggressive now in how they operate financially. In Western Pennsylvania people have not historically been aggressive financially. It used to be that people waited until rates were two or three or four percent lower to refinance. Now we see people refinancing mortgages that are three-fourths of a point lower. You also have probably the highest percentage of cash buyers than we ever have.”

Scarmazzi has seen the trend in cash buyers emerge as well, although it is not a new phenomenon for his market segment.

“We started out building for the Eisenhower generation and 75 to 80 percent of our customers were building with cash. When money was free and rates were two or three percent, I would say we had 40 percent cash buyers. As rates have accelerated, we are trending back towards that 70 percent rate,” he says.

Taken as a whole, the new construction outlook for 2023 should not buck the trends of the past few years. Mortgage rates have likely peaked, but are also likely to remain at an elevated level compared to the 2010s. Lenders are tightening standards and showing a diminished appetite for new development throughout the U.S. That trend will be exaggerated in Western PA by the limited availability of land that is easily developed. New construction costs will remain high, on a square foot basis, compared to existing homes. Until conditions change significantly, new construction in metropolitan Pittsburgh will be closed off to buyers looking for affordable options.

“If you’re a new buyer or first-time buyer in the market, you’re going to have a problem buying new construction. It really makes new construction a move-up market,” says Hunter. NH