New residential construction plays several key roles in the U.S. housing market. New construction provides a way for growing cities to keep growing across all demographic groups. New construction has historically been the relief valve for a tight inventory of existing homes, offering families looking to move up an alternative when demand exceeds supply (like right now).

Custom home building is often the best solution for the high-end buyer. And new residential construction once offered a great solution to meet high levels of demand for first-time buyers.

The latter may not resonate in today’s housing market, but for the three decades following the end of World War II, large-scale new home construction was the fuel that fed the fire for the middle-class home buyer. Millions of homes were built by tract builders in communities all over the U.S. Beginning in Nassau, Long Island, Levitt and Sons, Inc. built as many as 30 homes per day in four “Levittowns” in New York, New Jersey, and Pennsylvania from 1947 to 1951. This model built the supply of new homes that kept up with the exploding demand for home ownership from the newly prosperous middle class of America.

Since 2000, however, a host of market conditions have made it more difficult for new construction to economically meet first-time buyer demand. At the same time, an unprecedented demographic shift in behavior has steadily pinched the inventory of existing homes for sale. This confluence of higher cost of new construction and low existing homes for sale has created a booming housing market for those who already own homes. For those who are looking to become homeowners, however, the market conditions seem to be keeping affordability just out of reach.

The Housing Bubble Broke the Market

America’s Great Depression, and the subsequent World War, fostered a change in how society viewed home ownership and the social contract with Americans. Franklin Roosevelt’s administrations sold the concept of a social safety net, which included Social Security, to the majority of American voters who did not need such a safety net. The widespread privations that the Depression visited upon so many Americans spawned empathy and support for FDR’s New Deal. The pain and suffering of World War II, felt by almost all Americans, heightened the sense that the benefits of society should be available to all.

Home ownership was among those benefits. When the government created financing options for veterans after the war, which made home ownership possible for millions more people, a prosperous and grateful citizenry went along for the ride.

It is worth noting how much of a change in direction the New Deal and its succeeding policies were from the status quo. The 1939 film It’s a Wonderful Life portrays banker and businessman Henry Potter as the story’s villain, but his diatribe concerning the loose lending practices of the Bailey Building and Loan (“What does that get us? A discontented, lazy rabble instead of a thrifty working class.”) is representative of the sentiment about home ownership prior to World War II. From after the war, through Lyndon Johnson’s Great Society and the policies of Bill Clinton and George W. Bush, the policies of the federal government trended towards the goal of every American owning a home.

The pendulum swung too far in that direction in the mid-2000s, when financial regulation loosened, and financial products became too sophisticated to be effectively regulated. The result was a glut of new construction and home purchases that became loan defaults. The global financial crisis that followed produced several legacies that haunt the housing market to this day.

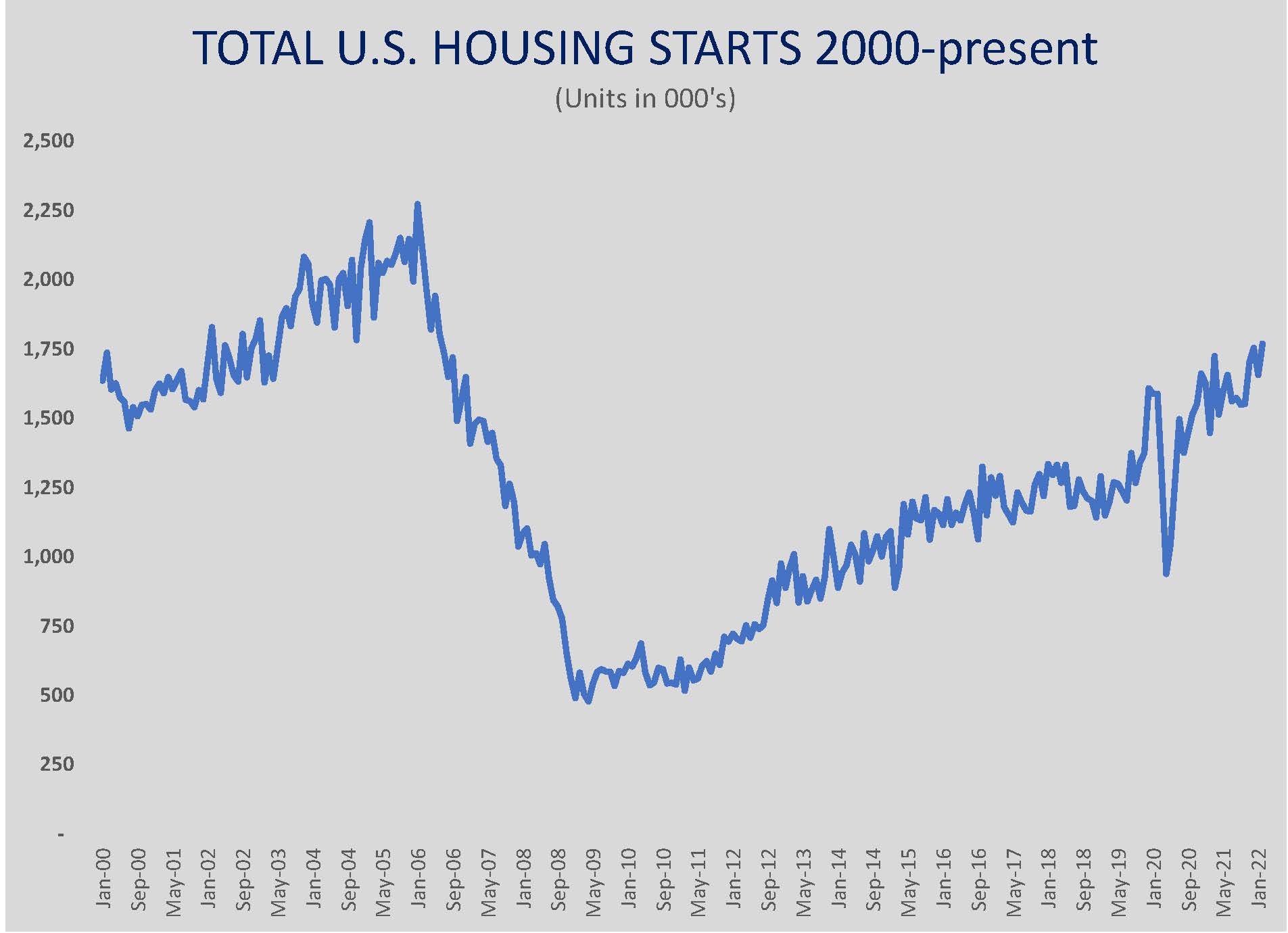

First was a wave of foreclosures and bankruptcies that left the U.S. with as many as seven million excess homes in the inventory to be sold. Home values plummeted. Financial institutions failed and credit dried up for mortgage origination. This reduced the number of homes built to less than one half the long-term average for a decade, setting the stage for the inventory shortage of today.

Second was the backlash on mortgage regulation, which raised loan-to-value ratios and squeezed liquidity by requiring that lenders have much larger reserves against bad loans. The latter regulation was part of the Dodd Frank Act, which made mortgage lending more difficult. A misconception arose at the time that buyers needed to have a 20 percent down payment to buy a home. While that was true in certain limited categories of real estate, there were mortgage products available by 2009 – like Federal Housing Administration loans – that underwrote mortgages with as little as three percent down payment. This misconception lingered for more than a decade as well.

The third legacy of the financial crisis that lingers today also resulted from lending regulation tightening. Financing conditions for residential development, which is a commercial loan, tightened dramatically. Banks were reluctant to finance new developments in the wake of the housing bubble, and the tighter regulations – most of which diminished the return on investment of new developments – cooled demand from developers. The result was a dramatic decrease in the development of new lots for construction. When demand for homes returned in the later 2010s, there were not enough lots to meet it.

It took less than a decade to go from housing bubble to housing shortage. Since 2018, the tight market conditions, coupled with an extended economic boom, have driven double-digit home price appreciation each year. While there is widespread recognition of the shortage, there are few incentives for developers or builders to risk overextending themselves again. Even after 15 years, the pain of 2007 and 2008 is remembered well.

A demographic sea change is the icing on the cake for the current housing market conundrum. A combination of good health, more wealth, and caution has extended the time the average homeowner spends in their family home. The average time that an American owns a home has gone from seven years to almost 11 years during the past decade. Older Americans are staying in the homes in which they raised their families, reducing the options for move-up buyers, which reduces the number of starter homes on the market.

These elements combined to make the 2010s a decade when the number of homes built simply was not enough to meet the needs of the Millennials, a younger generation that was even larger than the Baby Boomers.

How is all this shaking out in the marketplace? According to the National Association of Homebuilders (NAHB), the effect of the multi-year, double-digit price appreciation has priced 69 percent of Americans out of purchasing a home at the median price point. The NAHB annually conducts its “priced out” research and found that 87.5 million U.S. homeowners could not qualify for a 30-year mortgage at 3.5 percent interest, assuming a 10 percent down payment at a mortgage-to-income ratio of 28 percent. NAHB estimates that an increase in price of another $1,000 in 2022 would eliminate an additional 117,932 buyers who could qualify in 2021. For Pittsburgh that estimate is 1,059 buyers. While the NAHB study used the median price as the standard, the same price pressures have been pricing out first-time buyers.

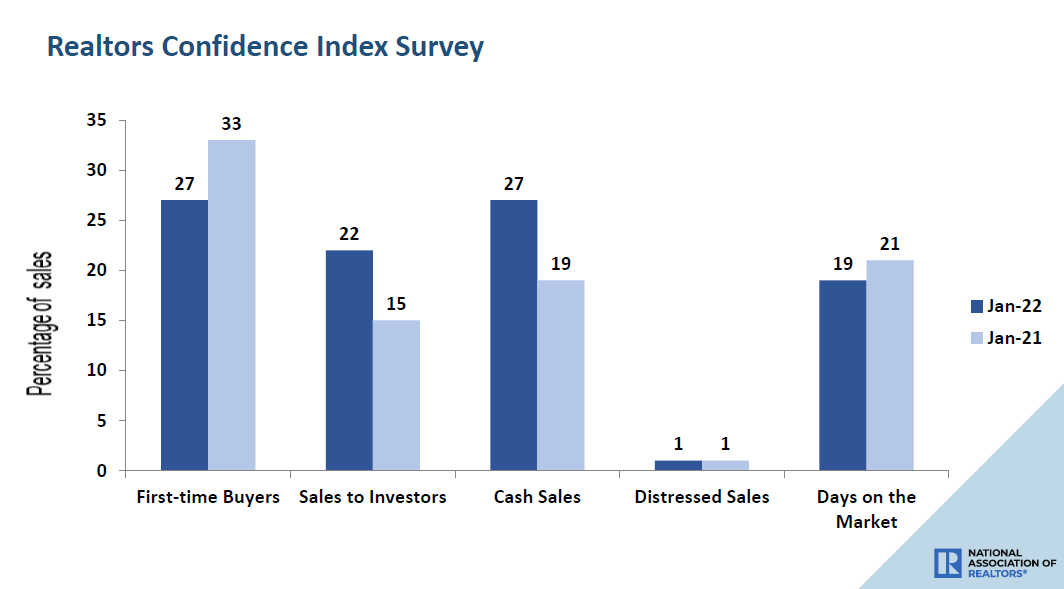

The share of first-time buyers declined in 2021, after rising again in recent years. At the same time, the share of home sales to investors rose. In its most recent survey of homebuyers, the National Association of Realtors (NAR) reported that tight inventory and savvy buyers were making it more difficult for first-time buyers to purchase. Highlights of the results from January are:

First-time buyers made up 27 percent of purchases, compared to 33 percent in January 2021. First-time buyers typically comprised 40 percent of the market prior to the Great Recession.

Cash buyers made up 27 percent of purchases, compared to 19 percent a year earlier.

The share of investment buyers jumped to 22 percent, up from 15 percent in January 2021

The median sales price of a home jumped 15 percent year-over-year, to $350,300.

While market conditions have cooled slightly – as measured by the average number of bids per transaction – the rising prices present conditions that favor the investment or cash buyer, since those bids are more desirable to sellers than those that risk financing delays or cancellations. NAR spokespersons were unaware of another time when the share of all cash buyers equaled the number of first-time buyers, but NAR Chief Economist Lawrence Yun emphasized that the housing market will require a significant increase in homes for sale or new construction to cool down.

“We’re moving in the right direction. But I would still say that we are short by three or four million housing units in America, so we still need to ramp up supply,” says Yun.

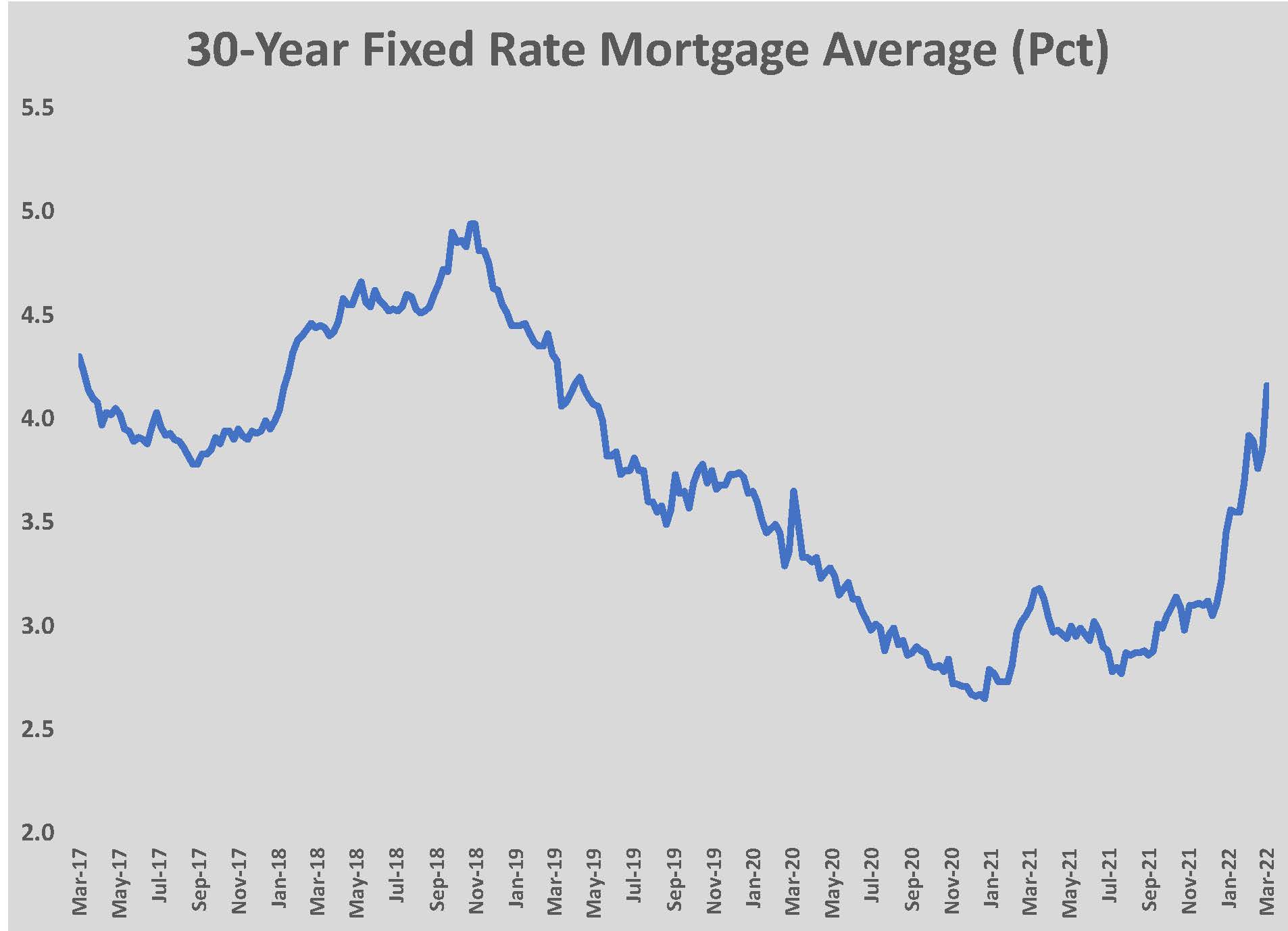

The emphasis on supply is well placed, but there may be a perception problem that the industry needs to address as well. The common perception, which has lingered since the mortgage crisis, is that home prices are too high for first-time buyers. That may be true of the overall home inventory, but because of the historically low interest rates and a strong labor market, affordability may not be as drastic a problem for first-time buyers as the media is portraying.

The price of a starter home varies significantly from region to region, especially considering the wide range in new construction prices, but the median starter home price was a few dollars shy of $250,000 in February. For buyers who can come up with a 20 percent down payment, the monthly principal and interest payment for that starter home would be $990 for a 30-year fixed-rate mortgage. Most first-time buyers do not bring that kind of down payment to the table. In the case of a 10 percent down payment, the 30-year mortgage for that $250,000 starter home would carry a monthly payment of $1,348 until the premium mortgage insurance expired in the sixth year. At the conventional 28 percent debt-to-income ratio, a buyer would need a household income of less than $58,000 to qualify for the $225,000 loan.

While tens of millions of Americans would not find the $250,000 home affordable, the qualifying income for that mortgage is almost $3,000 less than the median household income in metropolitan Pittsburgh. That suggests that affordability is not the limiter that supply is, yet the perception remains that home ownership is out of reach. A March survey conducted by Apartment List found that 34 percent of Millennials felt home ownership was important to personal financial success and only 23 percent of Generation Z shared that sentiment. That compares to between 41 and 45 percent for Gen X, Baby Boomers, and the Silent Generation.

Tom Hosack, CEO of Berkshire Hathaway HomeServices The Preferred Realty, says that his firm’s experience is contrary to that research, at least as far as the traffic from thirty-somethings.

“If anything, the traffic of first-time buyers is up because of the demographics. As the Millennials are getting into that house buying range it is creating demand, which is really what is fueling this whole process,” Hosack reports. “The problem is the lack of inventory. There is a sort of hysteria when buyers that lose the chance at seven or eight homes and as a result will pay well over list price.”

“We are getting a very large number of pre-approval requests from first-time home buyers because they want to be ready when they find a house, but they are not turning into applications because they can’t find properties,” says Lisa Clore, senior vice president and director of mortgage lending at Community Bank. “I normally don’t do a lot of pre-approvals, but because of the volume now I have five that came in over the weekend. Very few are turning into loans. If something comes on the market, and you’re not the first people to look at it, it’s gone. Buyers are making offers over the asking price or they’re waving their right to an appraisal or inspection. I don’t blame them.”

Finding a Place in the Market for the First-Time Buyer

The home buying decision tree splits into two main branches: existing homes and new construction. Throughout most of post-World War II in America, first-time buyers pursued the inventory of existing homes for that initial purchase. Existing homes offered wider variety of sizes and locations. There have historically been many more existing homes on the market than new construction offered. And the cost of new construction tended to push the price significantly higher than what could be found in the existing home inventory.

Of course, there were always exceptions to the norms. In many fast-growing southern cities, there is ample available land that is easier to develop than in an older northern city like Pittsburgh. Construction methods and costs are cheaper. In those kinds of markets, it is more common to see a supply of new homes geared to first-time buyers. None of those conditions are true of Western PA, especially in 2022.

What is confounding to potential home buyers, and real estate agents, in 2022 is the lack of existing homes for sale. There are many more buyers than sellers, especially in desirable communities, which has left buyers searching for alternatives to what they are seeing in the desirable communities.

One option is to broaden the home search into communities that are not at the top of mind. Several blighted communities in Pittsburgh have seen real estate fortunes reversed dramatically during the past two decades. Formerly neglected neighborhoods like Lawrenceville, Bloomfield, and East Liberty have seen property values appreciate from $50 to $70 per square foot to more than $400 per square foot. Finding the “next Lawrenceville” requires more real estate savvy than most people possess; moreover, the buyers who took a chance in those neighborhoods were pioneers, not your typical family looking for a good school district.

The more likely communities that can serve as relief valves for rapid price escalation are the blue-collar towns that have lots of single-family homes but have seen decline since the 1980s. Some of these, like Sharpsburg and Verona, have seen a rebound in the past few years because they are older towns in good school districts. There are plenty of similar communities that have affordable housing stock and good schools, just not the districts that make someone’s “top 20” list. Among these places are Verona, Springdale, Coraopolis, Bellevue/Avalon, Dormont, Shaler Township, Brentwood, or Freeport.

“If you compare the sales volume in what I call the first ring – the communities that were built as the first suburbs outside the city – from 2021 to 2018, there has been a dramatic increase,” notes Howard “Hoddy” Hanna, Jr., Chairman of Howard Hanna Real Estate Services.

Hanna points to the activity of value-added investors, the so-called flippers, as creating a new inventory of homes for sale in these older communities. Because of the low purchase price, investors can fully renovate older homes and offer what is effectively new construction at prices below $300,000.

“Investors are going into those towns, which are not necessarily first choices for school districts, and renovating houses that the Millennial buyer wants, with housing open floor plans and amenities. They are coming in at a relatively affordable price. That kind of affordable housing isn’t being built any place else,” Hanna says. “A lot of people think $300,000 is high but that’s become affordable for working class people or first responders like police officers, firefighters, or nurses. They also provide a house that buyers don’t have to fix. The house is affordable and in the shape that the buyer wants.”

For buyers with an eye towards locating within the communities that are part of a high-ranking school district, Hosack recommends adjusting expectations for the type of home that a first-time buyer can afford. He recommends townhomes and suggests that it is a good fit for a younger generation that has not had home owning experience.

“My son bought his first home last year; my daughter’s buying her first home this year, so I’m a little bit in the game,” Hosack says. “This generation didn’t grow up like I did, mowing the grass and pulling weeds, so the concept of owning the home to them is scarier because they don’t know how to maintain it. The townhouse is perfect for them.”

For the most part, new construction is not a viable option for first-time buyers. New construction tends to locate in the more desirable communities that still have available land or lots. For at least two decades now, that has meant that first-time buyers of new construction needed to be shopping with a move-up buyer’s budget.

“If we build a starter home, because of the quality materials we use, it would be $500,000. Even if the land were free, we couldn’t build something that is a starter home for first-time buyers,” says Jeff Costa, founder of Costa Homebuilders. “It may not be what buyers want to hear but, in this climate, someone looking for a starter home should buy a condo.”

Paul Scarmazzi, CEO of Scarmazzi Homes, says his management team spends time regularly talking about a strategy for profitably building for first-time buyers. Scarmazzi Homes develops and builds homes that have traditionally been geared towards the empty-nester/retiree buyer. As the target audience for his homes has shifted from the Eisenhower generation to the Baby Boomers, he says the demand is for larger detached homes with more amenities.

“More and more of our customers are still working. I would say our average sales price has gone up closer to $500,000,” Scarmazzi says.

New construction has been unduly impacted by inflation and supply chain disruption since the pandemic began. In 2020, unexpected soaring demand for remodeling pushed lumber prices to triple their 2019 level. By 2021, as the global economy roared back from COVID-19 slowdowns, demand for all products greatly outpaced the ability to manufacture and ship. Prices of all residential components have risen by 15 percent, year-over-year. As disruptive as that has been to pricing, Scarmazzi notes that development costs have played a larger role in making starter home construction unaffordable to build.

“Land is getting more expensive with more regulations on development. There’s not a lot of flat land left so you’re dealing with slopes. They just brought back federal clean stream regulations that affect how we develop, adding thousands of dollars per lot,” he explains. “We have $55,000 to $60,000 per lot in land costs and the cost to put in roads, sewers, and infrastructure. That’s our cost, not including overhead and carrying costs.”

Scarmazzi agrees with Costa’s suggestion about the most viable solution for affordable new construction.

“We’ve been talking about that alot internally because the Millennials eclipse the Boomers in terms of demographics. Getting to affordability, it might have to be a townhome product or something that gets you density because it starts with the land. We’d love to find a more affordable way, but I think density is the only way that you can get there.”

One trend that has surprisingly not altered its trajectory during the period of rising home prices is the share of manufactured or industrialized homes. Also known as modular homes, manufactured housing makes up 10 percent of the total housing starts in the U.S. Manufactured homes offer a number of advantages to conventional stick-built homes, including affordability. The average manufactured home sold for 10 to 25 percent less than a conventionally built home. Yet, while manufactured homes have grown in appeal because of price, lead time, and sustainability, there is little evidence that the current trend in housing affordability (or un-affordability) is pushing demand significantly higher.

Pennsylvania is home to 10 home manufacturing plants. (Only Mississippi and Texas have more.) Yet, there has been no real change in the number of manufactured homes built in the Pittsburgh area in recent years.

The region’s top builder, Ryan Homes, is trying to fill the hole in the new construction market at lower price points by introducing a limited line of home plans under the Simply Ryan brand. Priced from the low $200,000s to the upper $300,000, Simply Ryan plans offer some of the same amenities that new construction buyers seek in a smaller, more efficient floor plan.

Simply Ryan plans have two-car garages, owner’s suites, open floor plans with larger kitchens and family rooms, and layouts that offer separate wings for the owner’s and children’s bedrooms. The homes run from more than 1,300 square feet to nearly 2,000 square feet. In the Pennsylvania markets, Ryan Homes is offering its two-story Simply Ryan homes, running from 1,400 square feet to 1,900 square feet. In Pittsburgh, the Simply Ryan home is being built at its Imperial Ridge neighborhood in Findlay Township, West Allegheny School District, and at Arden Wood in Lancaster Township in Seneca Valley School District.

In its marketing of the Simply Ryan brand, which NVR is offering in more than a dozen states from Illinois to Florida, Ryan Homes emphasizes the current equity between rent and mortgage payments. The builder also stresses that the quality of finishes and appliances in Simply Ryan homes will be on a par with bigger Ryan Homes models. Perhaps its most effective marketing message uses testimonials from buyers who did say that the news about the housing market made them think home ownership was not possible, until they looked at Simply Ryan. That is a Ryan Homes sales pitch, of course, but the message addresses the fear that inexperienced buyers naturally have in a booming market.

Lisa Clore notes that the inexperience of first-time buyers is more pronounced in a market where the price of the home routinely exceeds $200,000. She estimates that fewer than half of the prequalification requests that Community Bank has received meet the standards for credit or cash to purchase a home.

“I think because rents are so high, there are more people who are interested in purchasing but they’re not prepared financially or credit worthy,” Clore says. “We are doing mortgages that are virtually no money down but many of the borrowers do not have enough cash to cover the closing costs.”

Even if younger first-time buyers lack the financial strength to purchase a home in this rapidly escalating environment, the volume of applications for preapproval suggests that those surveys that show young Americans are not interested in buying a house may not be capturing the entire story.

Since World War II, Americans have shown a collective impatience that has led to both incredible progress and incredible setbacks. We tend to miss emerging trends that don’t fit our biased perceptions. Similarly, we tend to view any trend, no matter how temporary, as the new normal, often giving credence to the most extreme circumstances over the most likely. Demographics predicted that there would be a shortage of homes for a decade or more. The financial crisis exaggerated that trend. Most of today’s housing market conditions have either been caused by the pandemic or exaggerated by it. And just as the pandemic will eventually fade so will the conditions caused by it – supply shortages, inflation, and hyper-competition – as well. In fact, the Mortgage Bankers Association forecasts that annual home appreciation, which topped 18 percent in 2021, will fall below five percent later this year and remain in that range going forward.

That fact doesn’t make it any easier for first-time buyers to buy a home right now. Nor does it mean that the current conditions will not remain as the new normal. But it does mean that, like all other disruptions to normal life, this too shall pass. NH