Somehow, amid all the economic distress caused by the novel coronavirus COVID-19, the U.S. housing market is in robust condition. It seems that with each passing month the reports on home price appreciation or existing home sales are rosier than the month before.

With the first deliveries of effective vaccines underway before Christmas 2020, the prospects for recovery in 2021 seem good, making the prospects for the housing market that much better.

As goes the housing market, so goes the mortgage market, and vice versa. You only need to look back a decade to realize that one can’t function well if the other is struggling. It shouldn’t surprise you then to discover that the mortgage market is also having a banner year, in spite of the dire economic situation. Mortgage origination volume, both for purchase and refinance, is expected to jump 50-to-75 percent from 2019 to 2020 once the dust settles. Bankers might like the interest rates to be a bit higher but, all in all, it will be tough to imagine any lender frowning about a 50 percent increase in business!

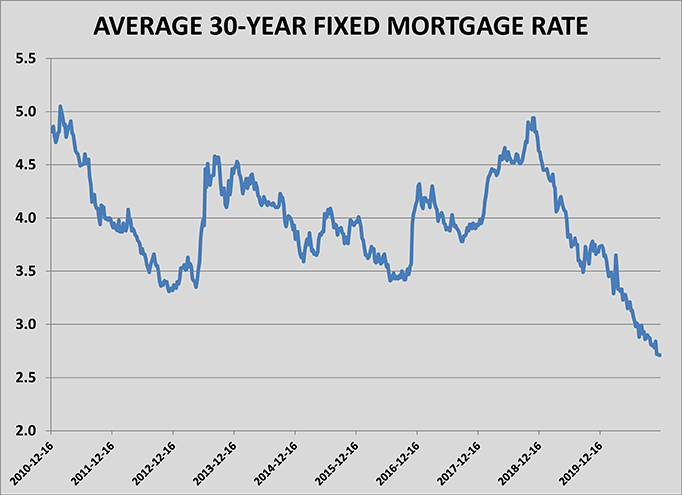

“We were getting refinancing requests from people who bought homes a year earlier with interest rates above four percent. Right now, that 30-year rate is at 2.75 percent,” says Mike Henry, senior vice president of residential lending for Dollar Bank. “But our purchase volume was still pretty good. We were close to 50 percent of our mortgages for purchase. Home ownership rates increased during COVID and, of course, the rates are actually lower now than they were from March until August.”

Looking ahead to a recovery in 2021, the business of borrowing and lending money should remain robust. As has happened in the past when interest rates plunged, the rush to refinance in 2020 means that fewer re-fi opportunities will exist in 2021; however, the expected volume of mortgage originations should still top the volume of 2019.

What’s behind the good news? It’s a combination of good old supply and demand, lessons learned from 2007, regulations that worked as planned, and low interest rates for more than a decade. The tiny silver lining in the massive cloud that was the housing bubble and financial crisis of 2008 was that the aftermath created conditions that kept the housing market from becoming imbalanced. That isn’t likely to last forever; however, even bankers will agree that the constraints (or at least most of the constraints) put on lending in the Dodd Frank Act have been effective at preventing the kinds of disruptions that happened twice in 20 years. And that’s a good thing.

America’s middle class was built, in part, by the 30-year mortgage. Working class Americans were able to save a down payment and have an affordable monthly payment that built equity over time. Instead of making a landlord a profit, American homeowners were able to build the most basic foundation for long-term wealth: home ownership. Americans had a tough year in 2020. The fact that Congress protected homeowners from foreclosure will help most Americans maintain that financial foundation as the U.S. recovers towards normalcy.

The Housing Market: Healthy in a Pandemic

If it seems a bit confusing that the housing market in the U.S. could well be at its healthiest while the U.S. economy is terribly unhealthy (literally), that’s because the state of things in 2020 defies both logic and history.

The explanation for the good market is fairly simple, even if it is multi-faceted. At a time when so many people are out of work, the rest of the workforce is doing as well, or better, than before the pandemic hit. Investments and savings accounts have swelled again. More than anything else, the low interest rate is making home ownership cheaper than it has been in decades, even as home prices are appreciating at a record-breaking pace. That means that demand for mortgages is making bankers very busy. In addition to the high volume of mortgage for homes purchases, the pandemic sparked a surge in home renovations and additions. In turn, that helped boost the number of refinancing and home equity borrowing. All in all, it’s a good time to be in the residential mortgage business.

“Interest rates are at all-time lows and the Fed came out earlier this week and said that the rates were going to remain low. I’m excited for another robust year for the mortgage market,” says F. Duffy Hanna, president of Howard Hanna Financial Services. “The Mortgage Bankers Association (MBA) also came out with a recent report projecting that home sales are going to be up in 2021, so that’s exciting news. It even looks like home starts are predicted to be up next year. The wind is at our back in the housing industry.”

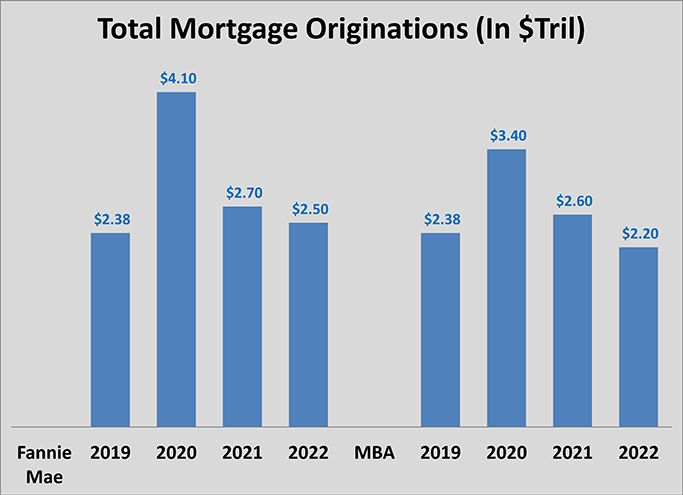

Final data on mortgage financing activity for 2020 is still being tallied but the volume into December makes it clear that the year will be the most active on record, except for 2003, when $3.81 trillion in mortgages were originated. Although 2020 will be an outlier for several reasons, the trend of higher volume was underway in 2019. Mortgage originations in 2019 totaled $2.38 trillion, which was the second-highest total at the time. While volume is certainly being pushed higher by refinancing, the volume of purchase originations was nearing the all-time high of $1.51 trillion closed in 2005. Favorable conditions for buying and borrowing have existed for several years.

“Overall mortgage financing picked up strongly late in the first quarter of 2020 and continued all year. Purchase financing picked up in the third and fourth quarters. Demand for home purchase financing should continue to grow through 2021, although refinances are projected to normalize and slow a bit,” predicts Joseph Cartellone, executive vice president, director of mortgage services for First National Bank. “Many lenders expanded their capacity for residential lending in 2020 due to the increased number of refinance loans. Homeowners were refinancing at a rate we haven’t seen in a long time, likely to take advantage of the low interest rate environment and the opportunity to put extra cash in their pockets, build equity faster, or even to pursue a renovation.”

Of course, the year did not unfold as smoothly as it ended. Lenders expectations for a slightly higher volume in 2020 were quickly dashed by the outbreak of COVID-19 in mid-March. The pandemic led to business shutdowns and massive unemployment initially. That created lots of uncertainty about credit; however, the CARES Act helped provide a lifeline and the Federal Reserve Bank’s decision to cut rates to nearly zero opened the flood gates for refinancing. The increased time people spent at home also sparked a surge in home improvements, which added more loans to the pipeline. Concerns about home buying proved unfounded. Even the mechanics of lending that were disrupted by the pandemic – appraisals and closings – were adapted to an environment where people could not meet in person.

“We had to improvise a lot with how we did our closings. I will say the title agencies were good at figuring out a way,” says Lisa Clore, senior vice president and director of mortgage lending at Community Bank. “They even stood between two cars and passed the paperwork back-and-forth between the parties on occasion. With a new home purchase, we had closings at the empty house with the real estate agents where the buyers went inside to sign and the sellers went in to sign separately and then everyone left.”

“We went through a period of time where Fannie Mae did not require interior inspectors because people did not want appraisers in their home. We were concerned that court houses wouldn’t be open when we closed loans to file liens. That didn’t turn out to be an issue either. We had people closing loans on car hoods or back decks, where one person would come out and sign and then the other,” recalls Henry.

“At first we didn’t know what was going to happen, whether there would be a big wave of unemployment that would lead to all kinds of problems,” he continues. “We doubled up on our employment verification, checking at the last minute to make sure that a borrower was still employed. But none of the problems happened. It was really nothing different from normal, but for a whole lot of people wanting to refinance for the low rate. We have the highest volume we’ve ever had by a substantial amount.”

Economists for Fannie Mae, the government-sponsored enterprise (GSE) that purchases the majority of mortgages originated in the U.S., predict that the volume in 2020 will be even higher than the MBA, reaching $4.1 trillion when the year ended. Policy makers for Fannie Mae, and sister agency Freddie Mac, are indicating that the massive housing agencies will maintain their market position for the next couple of years, with an eye towards supporting affordable housing purchases. The incoming Biden administration is less likely to move the GSEs out of government sponsorship, ensuring that policy intentions will be carried out.

Experts at the Mortgage Bankers Association don’t expect market conditions to change, although a decline in refinancing is expected to bring overall originations back down to $2.5 billion. If correct, that would mean mortgage activity for new purchases will hit an all-tie high in 2021.

“The residential mortgage market is anticipated to continue to grow in 2021. Interest rates are expected to remain low well into 2021. Many consumers are still working remotely, spending more time at home, and may be continuing to increase savings to put toward a new home purchase,” says Cartellone. “Together, these factors indicate that 2021 should be another strong year for home purchases, refinancing and new construction – presenting a favorable environment for individuals and families who are ready to buy.”

What is interesting is that the rosy forecast for the housing finance market isn’t built upon an unrealistic forecast for the housing market. Both the MBA and the National Association of Realtors (NAR) expect that the extended economic pain caused by the recession of 2020 will result in an increase in household financial distress and foreclosures. But, because of the overall strength of the market and economy, the housing market should be able to weather the storm better than a decade ago.

In 2010, the fallout from the mortgage and financial crisis was reaching its peak. By the time that year ended, almost four million homes had been placed into foreclosure. Since the outbreak of COVID-19 in March, forbearance and the CARES Act kept lenders from foreclosing; however, the level of delinquency has continued to rise. It’s estimated that 3.3 million mortgages will be delinquent when forbearance ends. While that is a number that could cause a ripple of pain, there are several factors mitigating the impact on the housing market.

First, homeowners have five times more equity in their homes today as in 2010, when the U.S. average loan-to-value ratio was 94 percent. That meant selling the home couldn’t get the owner out from under water in 2010. Today, the average loan-to-value is 70 percent. That provides banks an incentive to refinance the mortgage, giving homeowners opportunities to extend repayment at low interest rates. Homeowners who must sell will have enough equity to pay off the mortgage from the proceeds. Should owners choose that route, buyers are plentiful. The inventory of homes for sale is extremely low, with less than three months’ supply on the market.

More than any other factor supporting the housing market, the steady increase in home values is cause for optimism that even distressed homeowners can ride out the storm. Since 2010, the average home price in the U.S. has increased by 49 percent, according to the NAR. That trend has been accelerating during the past five years, peaking in 2020. NAR reported that the average home price increased 14.8 percent, to $312,000, from January through October. Online real estate brokerage Redfin reported year-over-year appreciation of 16 percent, to $322,828, for the median home sold through November 29. In Pittsburgh, the average home sold was $201,000. These rising prices give lenders and borrowers who need assistance room to maneuver. Refinancing or extending a delinquent mortgage on a home that has appreciated more than $18,000 over the past year – as the average Pittsburgh home has done – has a lower risk for the lender and doing so may eliminate the need for foreclosure.

It seems likely that mortgage foreclosures will rise in the coming months, causing pain and forced sales of homes, but the housing market will be able to absorb the disruption that occurs.

Having a housing market that can withstand disruption will be important for the economic recovery in 2021, particularly because the supply and demand fundamentals are extraordinary. Buyers still outnumber sellers throughout the country. In Pittsburgh, the inventory of existing and new homes for sale in December was just more than two months’ supply. In a balanced market the inventory is five months’ supply. As late as the fall, NAR was reporting as many as four offers per home in most of the top ten markets. That is unusual, if not unique, for a steep economic downturn; however, it’s not an unusual development for supply and demand to get out of balance during most business cycles. What makes the cycle different is the fact that little or no relief to the imbalance is in sight. That is, to a large degree, a remnant of the Great Recession.

New construction is the relief valve for a tight supply. When the supply of existing homes tightens, especially when tight supply pushes prices briskly higher, the demand for new construction rises. Because new construction takes six months or more to complete, home builders will increase the supply of speculative homes in tight market conditions. But, after the collapse of the mortgage market and subsequent heightened regulations on lenders a decade ago, spec home construction became more limited. Other regulations made conditions very unappealing for new residential development. The result was a lot shortage that lingers to this day. As of November 2020, there were 3.3 months’ supply of new homes for sale. That’s roughly half the number of homes needed for the market demand.

The shortage of existing homes for sale is a function of an unexpected change in demographic influences. A forecaster looking forward ten years in 2010 would have expected a surge in existing homes for sale today because of the transition of aging Baby Boomers from family homes to downsized living quarters. That hasn’t happened because older Americans have taken better care of themselves. Healthier retirees are making the market unhealthy.

“The Baby Boomers need to move out so people can move up,” Hanna jokes. “There is a market for empty-nester housing, but I think the Baby Boomer generation has remained healthy and aren’t moving. My parents are in their seventies and have lived a healthy life. They are probably in the same shape as someone who was 15 years younger a generation ago. They don’t need to move from their home.”

Hanna’s anecdote is backed up by the data. In the metropolitan Pittsburgh market, new home construction remains stuck in a narrow range of single-family starts since before the Great Recession. There have been between 2,500 and 3,000 single-family homes of all types built each year since 2007, when the shortage of lots forced a decline. New construction peaked in the six-county market in 2005. Even though the Pittsburgh economy has had a strong recovery and a burst of new jobs created from 2011 through 2015, new home construction is mired at levels that are 1,000 homes short of the mid-2000s peak.

The question for the housing market, both in Pittsburgh and across the U.S, is not whether demand will persist, but whether supply can catch up. For 2021, the answer is likely to be no.

The Outlook for 2021

Regardless of whether supply and demand remain out of balance in 2021, the catalyst for more borrowing, low interest rates, will continue to be a spark; however, conflicting trends in the housing market overall may mean that home sales will not be as brisk, even with strong demand.

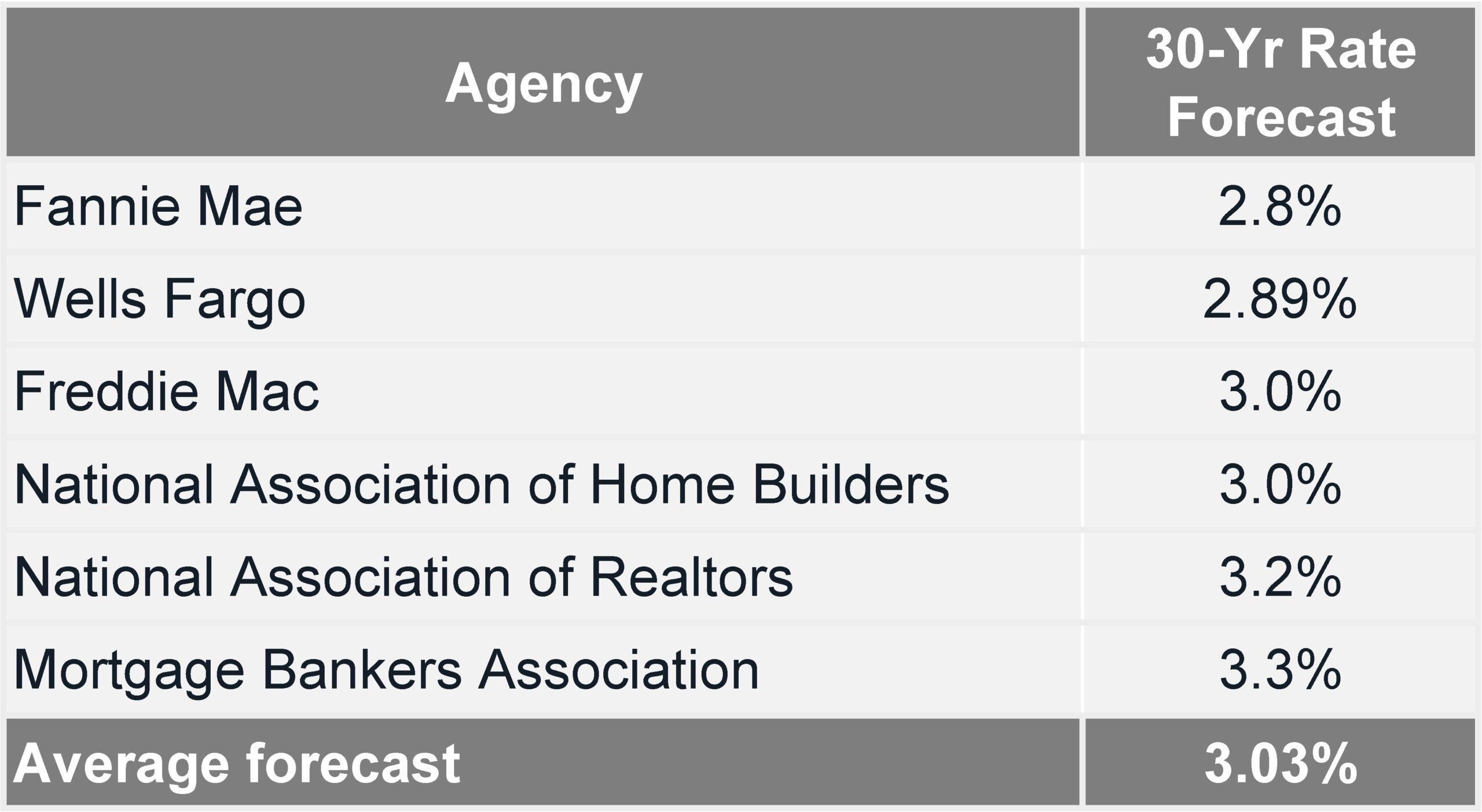

Forecasts for the interest rate on a 30-year mortgage are nearly unanimous among the major residential real estate agencies and associations. Predictions vary from a low of 2.8 percent by Fannie Mae to 3.3 percent from the MBA. The average of the forecasts is 3.03 percent, which is virtually where the market has been since the Federal Reserve Bank cut the overnight lending rate to 0.25 percent in March. The fact that the Fed has signaled that it expects that so-called fed funds rate to remain at 0.25 percent through 2022 all but assures that the three percent consensus from the agencies will prevail.

The accommodative rate environment will continue to stimulate home buying, even as the economic pain from COVID-19 lingers into 2021. One reality that is lost in all the upbeat housing news is the fact that most of the buying and borrowing – including refinancing – came from people on the upper end of the income spectrum. That means that the financial aid package passed by Congress at year’s end will be important as a bridge to recovery. Economic recovery that begins early in 2021, perhaps by the second quarter, will mean falling unemployment and will extend the housing market’s appeal to middle class renters and first-time buyers. Those two groups have been largely missing from the booming housing market.

“We measure our forecast by the pipeline and the number of loans we have unclosed is still at a record high at the end of the year,” notes Henry. “That’s very unusual for this time of year. This is typically the lowest time for application volume but it’s gone up over the last three weeks.”

Duffy Hanna sees the demand drivers that the pandemic stimulated also lingering into 2021

“I think people sat in their homes after the shut down during the spring and were able to notice everything that they thought was wrong with their home. They decided they needed an office, or that their kitchen was too small, or they needed an extra bedroom,” Hanna says. “Many people came through that time with a solid job situation and that spurred home sales. That should continue as the economy improves for more people. When you compare what you can afford at a rate of 2.5 percent instead of five percent – which was the rate two years ago – it’s considerably greater.”

The extended time at home was cited as the major motivation behind the increase in remodeling and additions that swept the U.S. and Greater Pittsburgh in 2020. This trend helped fuel the refinancing boom that occurred. That fuel is mostly spent, however, and the inventory of existing homes has not increased significantly. (It’s lower in Pittsburgh.) As a result, new construction is expected to pick up some of the slack again.

“We anticipate that new home construction will continue to increase as resale demand continues, and inventory of existing homes remains very low,” notes Joe Cartellone. “As we continue to navigate the pandemic, there will likely be some uncertainty about job stability and the economy, and more significantly, there is still a scarcity of homes available for sale.”

Real estate professionals expect the lingering impact of the pandemic to slow home sales slightly because new construction will not be able to ramp up enough to offset low inventory. New construction also leans to the middle-to-higher end of the market, which means fewer new homes will be in the first-time buyer category, which is where demand is expected to grow fastest in 2021. In Pittsburgh, new home sales fell slightly in 2020 from 2019, which was up four percent from 2018. The culprit was the low inventory of existing homes for sale and, although new single-family construction was up 13 percent in 2020, there weren’t enough new homes to offset the low inventory.

According to Tom Hosack, CEO of Berkshire Hathaway HomeServices The Preferred Realty and current president of West Penn Multi-List Services, home sales were up four percent to 31,400 units in 2020. He says that the forecast is growing inventory to lead to five percent more homes sold in 2021, at a sales dollar volume increase of 12 percent.

An expected decline in demand for mortgages, primarily due to refinancing activity running its course, will increase competition for borrowers among banks. That shouldn’t be expected to usher in a period of easing lending standards or conditions. Many of the tightest regulations of the Dodd Frank Act were eased during the Trump administration, but federal regulations on capital reserves for loan losses will put a cap on lending volume. Banks have begun tightening some standards because of the higher risk of lending in a weaker economy. Although the outlook for foreclosures is better for 2021 than a decade earlier, many borrowers have experienced financial stress that will increase the number of loan defaults.

Mike Henry doesn’t see the standards tightening in a way that cuts off home ownership.

“There really have been no outside regulatory guidelines that are more stringent. There were really no changes other than those addressing forbearance,” he says. “The market updated requirements on documenting income. That had to be a little tighter because it was possible that someone could apply and lose their job part way through the process. But we didn’t really see any major impact from that. There really haven’t been any problems documenting income or credit. Savings are up. Equity is up.”

“I look for underwriting to get a little tighter,” agrees Clore. “I think there will be more documentation needed and they may tighten up the debt-to-income ratio.”

Holding the line on underwriting would be good news, both for lenders and borrowers. Loosening the regulatory reins at a moment when the economy is fragile could be an incentive for third party and non-traditional lenders to become more aggressive than prudent. That kind of change led to problems in the 2000s. Tightening standards would create one more obstacle for the younger first-time buyer, which is a demographic cohort that continues to lag previous generations in home ownership rates.

“We keep tweaking our internal products for first-time buyers. The biggest obstacle we see for first-time home buyers is down payment. We have programs that will address that and, in 2020, there was record buying for that product,” says Henry. “The major issue with first-time home buyers right now is inventory and that’s something that we can’t solve. For 2021, we are looking at the guidelines to see whether it’s beneficial to bring in more first-time buyers, especially in low-to-moderate income census tracks.”

A significant increase in home ownership from younger buyers and a break in the logjam of existing homes available for move-up buyers would be the extra fuel that the mortgage market needs to offset the expected decline in refinancing.

“It will be a good year again, but it will be a different year. I do look for refinancing to slow down. It’s hard to believe that there would still be people out there that would want to refinance, although there probably are,” chuckles Clore. “I don’t think new home construction is going to change and I don’t see any real changes coming to the housing market. I think the home improvement projects that people were refinancing to do last year will slow down. I don’t think it’s going to slow down purchases or new construction in this market. There are still plenty of buyers.” NH