Mulling over higher interest rates, lower home inventories and skyrocketing price increases, what’s a potential home buyer to do? With the summer home buying season in full swing, national, regional and local experts weigh in on the housing market and mortgage rates, all with the ultimate goal of informing and educating buyers about the current state of affairs along with some considered opinions about future outlooks.

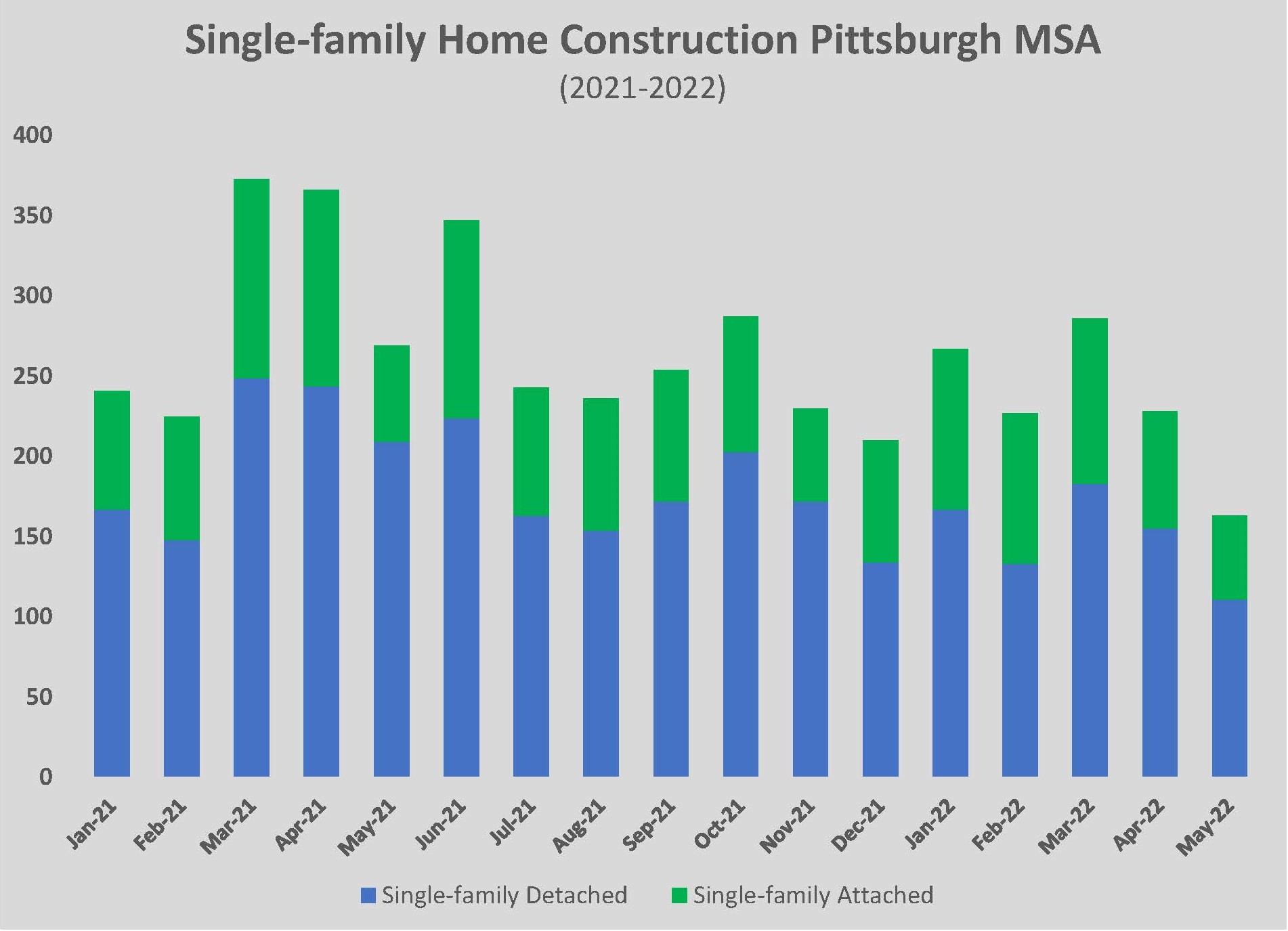

In order to understand some of the impetus behind the home buying conundrum, a quick examination of the recent past can help to unravel any confusion. According to the U.S. Census Bureau, new home sales were down 12.6 percent in March 2022 compared to March 2021. Further, the National Association of Realtors (NAR) noted that existing home sales were down 4.5 percent in the same period and pending sales, those signed contracts pending settlement, declined by 8.2 percent in March 2022 when compared to March 2021. A May 3, 2022, article titled “Rising Mortgage Rates Starting to Affect Residential Housing Market” (Michele Lerner, Washington Post) stated “The combination of the limited number of homes for sale, continuing double-digit price increases, and the sharp rise in mortgage rates is taking a toll on home sales across the United States.” Some good news came earlier in 2022 with a slight gain in housing affordability referenced by the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI) according to an NAHB article penned by Elizabeth Thompson, May 12, 2022: “Home Builders Warn of Significant Affordability Declines.” The NAHB/HOI saw that “56.7 percent of new and existing homes sold between the beginning of January and the end of March were affordable to families earning the U.S. median income of $90,000. While this is up from the 54.2 percent of homes sold in the fourth quarter of 2021, current market indicators point to worsening affordability conditions.” And, as hikes in mortgage rates rise, more buyers may drop from the ranks through lack of affordability. “Looking at current market conditions, affordability woes continue to mount as rising interest rates and home building material costs that are up 20 percent year-over-year are causing housing costs to rise much faster than wages,” said NAHB Chief Economist Robert Dietz. “The HOI falling below 50 percent using these real time estimates is an indication of significant housing affordability burdens, particularly for frustrated, prospective first-time buyers.” He continues by suggesting policy makers may ease these challenges by addressing ongoing supply chain disruption, thereby allowing builders to build more affordable homes. While the home selling/buying landscape still favors the seller, that scenario is cooling somewhat, given the higher interest rates and a slightly dwindling number of buyers. With inflation rising, the Federal Reserve is responding by raising short-term interest rates. “What’s happened over the last couple months is that inflation has persisted longer than people expected and at a higher rate than people expected,” said Danielle Hale, Chief Economist with Realtor.com. That’s raising concerns and the Fed, as a result, is raising short-term interest rates faster than expected even a couple of weeks ago.” Many, however, believe home affordability can still be accomplished, among them, Ralph McLaughlin, Chief Economist at Kukun, an AI-powered property technology platform for home owners and real estate investors offering unique access to home data analytics. He believes rising rates may not necessarily have to derail a home buyers plan. Acknowledging that while there is a “psychological barrier” when one sees mortgage rates that are nearly doubled from a short period prior, “in the grand scheme of things, 5 percent still isn’t that high of a rate.” Michael Henry, Senior Vice President, Residential Lending, Dollar Bank, echoes that sentiment, professing that a 5 percent rate, historically, is still a low rate. “Rate increases since January moved at a faster pace than anyone anticipated, which ultimately helps with inflation,” he said. He continued that rates are already backing off from 5.25 percent to 4.75 percent, “but that doesn’t mean they can’t increase again.” He has seen somewhat of a decrease in mortgage loans but says people are still looking to buy new homes in and around the Pittsburgh area. “The overall volume of homes for the year has realized fits and starts, but new home construction has been fairly strong,” he added. “New construction has addressed the home inventory shortage, but it’s hard to keep up with the demand.” He has also recognized lumber cost decreases due to some supply chain normalization along with numerous contracts coming in for new builds. Where he has seen significant declines has been with refinancing. “With the interest rates rising, it obviously doesn’t make good financial sense to refinance and these have virtually come to a halt.” He has also observed that some are waiting to see if the rates will drop further but “for a number of home buyers, when they find the right house, they jump into it.” Rates at Dollar Bank currently range from 4.75 percent for a 30-year fixed mortgage to 3.99 percent for a 15-year fixed mortgage but Henry cautioned that the 30-year rate could move into the 5 percent range for the next year or so. Joseph Cartellone, Executive Vice president, Director of Mortgage Services for First National Bank, the largest subsidiary of F.N.B. Corporation, also views refinancing as trending downward in light of increased rates. “When rates were at historic lows, FNB’s mortgage team saw significant levels of refinancing activity. Those customers who are looking to refinance in the current environment tend to be more interested in ‘cash-out’ refinancing, where homeowners pay off their existing mortgage and take out a new one for more than was owed on the previous loan. The borrower may keep the difference in cash that can be used for home improvements, to consolidate debt, or pay for other expenses.”

Rick Shrum, Vice President, West Penn Financial, is forecasting rates cresting just over 6 percent for the remainder of 2022 and expects to finish the year with his current rates of 5.75 to 6.25 percent, believing that “we are in a somewhat stabilization phase.” He has also noted a slowdown of loan applications at the start of 2022, but with the beginning of summer real estate activity, mortgage inquiries and applications are on the rise. “Inquiries for new construction and resale homes seem to parallel years past,” he explained. “But with the increase for housing on the rise, new construction is always looked at favorably.” The mix of buyers he sees consists of 40 percent first time buyers, 50 percent move-up/second time buyers, and 10 percent downsizing buyers. Helene Nseir, Real Estate Agent, Berkshire Hathaway Home Services The Preferred Realty, has discerned that interest in new construction has stayed steady. Most are move-up buyers looking to build or people who are downsizing and moving into one of the many patio home communities she sees dotting the area. “These are usually not first-time buyers, more likely move-up buyers, so they already have equity in their homes in order to buy a new one,” she stated. “Our biggest issue now is inventory of homes to sell, and these buyers are also confident in the sale of their own home.” She continued that it has not been unusual to write multiple offers for people who are looking for a home, and many times, they are outbid. As for land availability, she views it as a disappearing asset, with value rarely decreasing. “There is land available, but many people want to be in an established neighborhood with public utilities,” she added. Shrum noted that land purchasing inquiries are stable and comparable to years past. “Many buyers are looking for vacant land as an opportunity to build a customized home,” he said. “The affordability factor for land acquisition has not substantially ‘priced out’ buyers by the increase in value.”

Rising rates, low inventory levels, and higher home price continue to be top concerns for those seeking home financing according to Cartellone. “These issues, which are further exacerbated by concerns about inflation and economic volatility, can be particularly challenging for first time home buyers or families with less money to spend, which is another reason why affordable solutions and consultation continue to be priorities for F.N.B.,” he stated. He believes that home buyers could do themselves a disservice if they wait for rates or home prices to come down. “First, it’s important to remember that rates are rising from historic lows, so the environment is still positive from that perspective,” he remarked. “Delaying could put potential buyers at risk to experience further increased costs. This is still a competitive market and it is critical for prospective buyers to evaluate their priorities and goals and be prepared with prequalified or preapproval paper work.” He highly recommends that buyers speak with a mortgage expert who can help provide clarity on what a buyer can afford and connect them with potential solutions so they can have a plan in place to act quickly. Despite the lack of available existing homes for sale, he finds there is still more demand for mortgages for existing homes than for new construction. “However, low inventory has driven higher demand on the new construction side with significantly increased activity compared to what was typical for the past 10 to 15 years when housing starts were very slow following the financial crisis,” he concluded. Jason Stauffer in his NextAdvisor.com article posits that “buyers may still face bidding wars, but they aren’t likely to be as intense or as frequent. That means sellers may not be as selective when choosing between offers.” The article cautions that buyers should make a purchase when the time is right for them, not timing the rate market.

Builders, too, are realizing the fallout of rate increases and inflation, but are weathering the storm. One such custom home builder is Kacin Homes, founded by Richard Kacin and headquartered in Murrysville, just east of Pittsburgh. Building custom homes since 1960, Kacin’s current builds include Hillstone Village in Murrysville, featuring one and two story carriage homes starting in the high $400,000s, and single-family homes starting in the low $600,000s, all highly customizable, low maintenance and replete with high end finishes and materials, and North Meadow, Washington Township, noted for its low maintenance, well-appointed patio and single-family homes just off Route 356, also in Westmoreland County. Jason C. Corna, Kacin Company’s Vice President/Residential Division, shared that rising interest rates are pushing some buyers out of the market with primary concerns revolving around monthly payments and affordability. “The homes we are currently building are attracting empty nesters who are less reliant on large mortgages or mortgages in general,” he explained. “The interest in our current communities has continued to stay strong through the first part of 2022.” He finds that many people applying for mortgages are doing so as soon as possible to lock in current rates, but “certain restraints hold many back from applying for a loan including, but not limited to, home completion/closing dates.” He added further that “It’s difficult to determine how high interest rates will climb. We are being told they will continue to climb in 2022. No matter what the rates do, people of all ages will continue to build homes. There is no doubt that higher interest rates will push some out of the new construction market while others may choose to build smaller, less expensive homes.” Josephine Nesbit, a writer specializing in real estate and personal finance reported that buyers who signed contracts for new homes in 2021 and early 2022 expected rates around 3 percent. With the average rate growing to 5.3 percent (as reported by Freddie Mac and the Wall Street Journal), monthly payments can increase by nearly one-third (“How Buyers with Homes Under Construction Could Face Even Higher Interest Rates Before They Can Close”, May 17, 2022, Bankrate.com). For example, Michael Henry, Dollar Bank, explained that their average loan in the Pittsburgh area was about $220,000, so, if the rate increased from 2.87 to 5.25 percent, that would translate to a $250 payment increase each month, which could discourage some buyers from a home purchase.

Paul and Lisa Scarmazzi founded their namesake company, Scarmazzi Homes, more than 20 years ago to build luxury patio homes for people looking to simplify and right size. The company is consistently one of Pittsburgh’s top home builders and, as a builder partner with Epcon Homes and Communities, Scarmazzi Homes boast unrivaled feel, flow and function coupled with exterior services and innovative exterior courtyard areas for an outdoor living room. Current Scarmazzi plans include Aiken Landings in Robinson Township and Belmont Park in Chartiers Township, starting in the $400,000s; Highland Village, Union Township, and Villas of South Park, South Park Township, both starting in the upper $300,000s. All homes can be personalized with interior design in their Design Center, conveniently located in Canonsburg next to their corporate headquarters. Scarmazzi noted a double digit decline in mortgage applications during the month of May and a similar decline in home sales for the month of April. “It really has to do with affordability – as interest rates rise, it takes buyers out of the market due to increased monthly payments,” he said. “Unfortunately, with cost increases, fewer home sales do not necessarily result in lower prices at this point.” On the plus side, Scarmazzi continues to experience good traffic and solid sales in their plans given that many of their home owners are an older demographic and cash buyers. He also acknowledged that rising rates tend to dampen demand for first-time and move-up buyers, resulting in softening sales in these segments over the past 45 days due to rising rates, inflation and the stock market. “Simply put, people are seeing that they can’t qualify for the amount of mortgage for the homes they are looking to buy. Rates have doubled in a short time period and buyers are still processing what that means for them and their housing search,” he added. “I don’t think they’re ‘waiting’ to see if rates drop, but rather now processing what this means to them or understanding that the home they could afford six months ago, based on their monthly payment, might be out of reach at this point.” Scarmazzi does offer help to customers with the prequalification and mortgage processes through Princeton Financial, their preferred lender, to provide people with an exceptional level of service and expertise.

Joseph Cartellone, First National Bank, sums it up this way: “While interest rates are top of mind for many given recent actions taken by the Federal Reserve, it is important to remember that mortgage rates do not necessarily move in tandem with the Fed’s rate decisions. Mortgage rates are set by the market, and many elements can impact mortgage rates such as inflation, job creation, and how the economy is growing or shrinking. Although mortgage rates have been climbing from near historic lows, as of the end of May 2022, they have actually stabilized, even as the Fed has announced new, short-term rate hikes. This is good news for qualified, prospective buyers who should not let headlines about rates stall their home buying plans. Lenders are ready to work with clients to navigate the current climate and provide financing to meet their needs.” NH

Borrowing costs have already risen sharply across much of the U.S. economy in response to the Fed’s moves, with the average 30-year fixed mortgage rate topping 6%, its highest level since before the 2008 financial crisis, up from just 3% at the start of the year. The yield on the 2-year Treasury note, a benchmark for corporate borrowing, has jumped to 3.3%, its highest level since 2007.

Even if a recession can be avoided, economists say it’s almost inevitable that the Fed will have to inflict some pain — most likely in the form of higher unemployment — as the price of defeating chronically high inflation.